What we did

3.1.1 Our first household survey, this was distributed to all households in October 2019, helped us to better understand current and possible future housing needs, and what sort of development local residents wanted to see happen in their area, as well as their concerns. This elicited just over 300 responses

3.1.2 The second household survey, in February 2020, focused on employment in its widest sense, to include work, study, training or voluntary work. This was run at about the same time as the first business survey (aimed at local businesses) and had just over 130 responses.

3.1.3 The third household survey, in September 2020, sought to check the findings from the previous surveys in light of the Covid-19 pandemic, and dug a little deeper in terms of what people particularly valued about the local area. We received about 170 responses to this consultation.

What we found out

3.1.4 Most people responding to our surveys agreed that the Neighbourhood Plan should attempt to influence the location and appearance of any future development.

3.1.5 The main need suggested was for 2 or 3 bedroom homes, which should be eco-friendly, with off-road parking and gardens, and designed to be in keeping with the surroundings. Most people did not want to see more than 10 homes built in a 10 year period in any of the villages, although possibly slightly higher in Portesham. In general most people felt that any further development should take place within the existing village boundaries or through the re-use of agricultural buildings.

3.1.6 The survey results indicated that the main jobs were in either hospitality (including accommodation and catering), tourism (including recreation and other activities), manufacturing, and working for the public sector (administration and defence). Just slightly more than half of those responding travel to work outside the area (generally by car or van). About a third worked from home, for which reliable and speedy broadband and mobile phone connection was critical – and this was particularly important in light of the challenges during the pandemic. There was generally good support for small-scale businesses (including workshops) and further tourism enterprises, but no real appetite for attracting larger scale enterprises to the local area.

3.1.7 Some of the top concerns were about the prospect of increased traffic, affordability of housing – particularly for younger people, an increasingly ‘older’ or absent community, loss of village identity and adverse impact on views and outlook. Although highway safety issues were raised during the community consultations, they are not something that the Neighbourhood Plan can readily address unless they are directly related to development – so we would encourage any residents to raise their concerns through the Parish Council who will liaise with the Highways department in Dorset Council to see what, if anything, can be done.

3.1.8 Access to the countryside and coast, the views and vistas, the local wildlife, the peacefulness, the low crime rate, the sense of community (and the various village amenities where they exist), the history of the area were all important factors that made the area a great place to live. Various suggestions were put forward in terms of the most important views and spaces in the area.

3.1.9 Most respondents said that they would be in favour of renewable energy schemes to make our villages more self-sufficient and reduce the cost of energy supply – particularly if these could be community-led.

The full reports on the findings of the consultations can be found at

https://vision4chesil.org/plan-documents/

What we did

3.2.1 A business survey was undertaken in early 2020, the idea at that time being for the larger businesses to be contacted with the survey, followed up with a face-to-face meeting. With the lockdowns relating to the Covid-19 pandemic coming back into force, this level of engagement was curtailed, and this was reflected in the more limited level of responses received. A further follow-up survey (using the same questions by and large) was run in late 2021 to check the results. We received about 40 responses altogether.

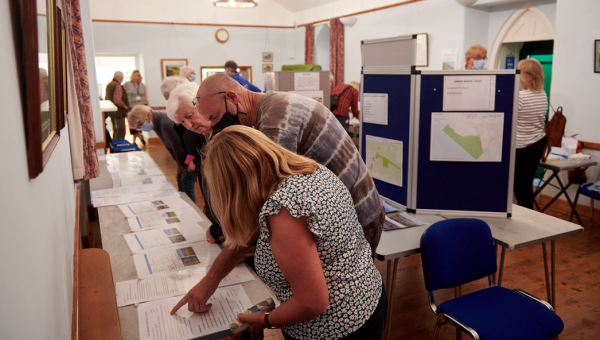

Figure 9: Example of one of the many Consultation Drop-in Events

What we found out

3.2.2 In terms of the type of jobs people were working in, this varied greatly. The four ‘top’ jobs were in either hospitality (including accommodation and catering), tourism (including recreation and other activities), manufacturing, and working for the public sector (administration and defence). This is broadly similar to the 2011 Census findings, where tourism was notably more important in Abbotsbury and the smaller settlements than it appears to be in Portesham.

3.2.3 The response from local businesses, in terms of their own staff, suggested that about two thirds of the businesses were either sole traders or micro businesses (employing fewer than 10 staff). The vast majority (84%) had their own (dedicated) business premises. Just over a third of people responding to our household survey either work from home or within a mile of their home, and about half commute to work outside the area.

3.2.4 About half of all businesses said that they did have difficulty recruiting staff, the main reasons being the lack of appropriate skills and transport (for staff coming to work but living outside the area).

3.2.5 The key factors suggested as being important for business success included:

3.2.6 We asked local businesses what changes, if any, they foresaw making to their business in the next 5 years. Most were looking to improve their current premises through repairs and internal alterations, rather than making external changes, or to move. This suggests little pressure for change / new employment sites from existing businesses.

3.2.7 We also asked through the residents’ survey whether anyone was looking to establish a new business in the parish or relocate an existing business to here within the next 5 years. Of those responding to our survey, a total of 4 people answered ‘yes’. Whilst they did not indicate the type of business, the type of premises required included studio and old barn / redundant buildings.

3.2.8 Our follow-up business survey found that over the time of the Covid-19 pandemic and Brexit, supply chains had become more unreliable and costs had increased, and more businesses than not had seen a decline in revenue. However most were confident that their businesses would ‘bounce back’, helped by more local spending and UK-based tourism, but there was still a lot of uncertainty. Most businesses had not seen a shift towards more home working, but did agree that broadband capability and affordable homes locally were more important than ever.

What we did

3.3.1 An online Young Person’s Survey was done in September / October 2020 and was publicised through the Newsletter. All residents were asked to encourage their children to respond. The survey was made available on Survey Monkey in late September 2020 for them to complete online only. The level of response was disappointing, with responses from 12 young people – but nonetheless gave some useful insights.

What we found out

“We like the beautiful place we live in and it is really good for families. I like the history of my village. I really like being outdoors and riding my horse, just enjoying the fresh air where I live. Most people are very friendly in my village and this is good for the community. I think it is important that we are always a welcoming community. We like going to the village shop and having some independence as we are growing up. My parents like the pub but I don't - I think adults rely on it too much. I liked the play area in my village when I was younger. We like the peaceful village and it's nice to go home after a busy day at school."

3.3.2 Our young people appreciate the beautiful countryside, the peace and quiet, and the friendliness of neighbours, but the rural nature of the area does mean that they generally feel more isolated from their friends and activities (many of which are based in the town), and the internet / broadband reception is also poor (which has been particularly difficult for home schooling and for socialising).

3.3.3 Most sporting activities young people get involved in take place outside the village they live in, but they do like to socialise with friends locally. The ‘lack of available activities’ was the main reason why they did not participate locally. Ideas for new activities were quite varied, although the possibility of a gym was raised by nearly half of those responding. Linked to this, was the issue of road safety for cyclists.

3.3.4 Environmental issues were clearly of some significant interest to young people, and also natural history, with some, but more limited, interest in the history of the area. In terms of new homes, most young people felt strongly that these should be eco-friendly and energy efficient (although many also felt this should ideally be in keeping with local character) and have good garden space.

What we did

3.4.1 In order to prepare for the Options Consultation Meetings a number of documents and material were produced and published:

3.4.2 In addition to publicising the consultation online, open sessions of 2 hours were advertised and held in each of the villages starting with Abbotsbury on Friday 10th September and culminating with Portesham on the 25th September, with each village hosting 2 separate sessions, one in the evening and one in the daytime. People were free to attend any session they chose, not just the one in their own village. Attendance was varied and in some instances disappointing but just over 70 surveys were completed either at the venue or subsequently on line and the results of these were fed into our ongoing analysis.

3.4.3 It was felt by the Steering Group that we should seek additional input from the residents of Portesham, mostly since there were very few surveys returned and there was a particular site that could possibly go forward into the Neighbourhood Plan. Consequently it was decided to re-open the survey, primarily to give the residents of Portesham Parish another opportunity to complete it, and fliers were posted through each letterbox in that village to raise awareness of the need to comment. This did result in a number of additional responses.

3.4.4 Further consultation on the additional housing options sites put forward for Fleet (in responding to the need for clarity on the location of FL11 at Bagwell Farm) was not considered necessary given that the site option assessment suggested none of the possible sites would be suitable for allocation.

What we found out

3.4.5 Whilst the results were not conclusive about local residents’ views on the different site options, it was clear from the feedback that a number of the site options were unlikely to be supported, given the high proportion of strong negative responses.

3.4.6 In deciding which sites to take forward as site allocations in the draft plan, the site assessment ratings, together with the results of this consultation including the comments made against each site, were all taken into account. Where issues were raised that might be possible to resolve, further discussions were held with the landowners

3.4.7 In addition to feedback on the site options, the consultation also sought to gauge the importance of the Local Green Spaces and Important Views identified from earlier work. This confirmed that all of the Local Green Spaces (considered individually) were important to the majority of respondents, with on average 60% of those responding stating that they were “very important”. The Abbotsbury sites tended to score lower, reflecting the lower turnout from that area. The views were even more highly supported, with on average 82% of those responding stating that those selected were “very important”.

3.4.8 The consultation also invited feedback on the design guidance, with the majority of respondents supporting the guidance for each of the areas (less than 5% felt that it was not important), and more detailed comments were reviewed prior to drafting the plan.

Figure 10: Banner used to advertise the open event

< Previous | ^ Top | Next >